Unlocking the Land: A Comprehensive Guide to Oregon Tax Maps

Related Articles: Unlocking the Land: A Comprehensive Guide to Oregon Tax Maps

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking the Land: A Comprehensive Guide to Oregon Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Land: A Comprehensive Guide to Oregon Tax Maps

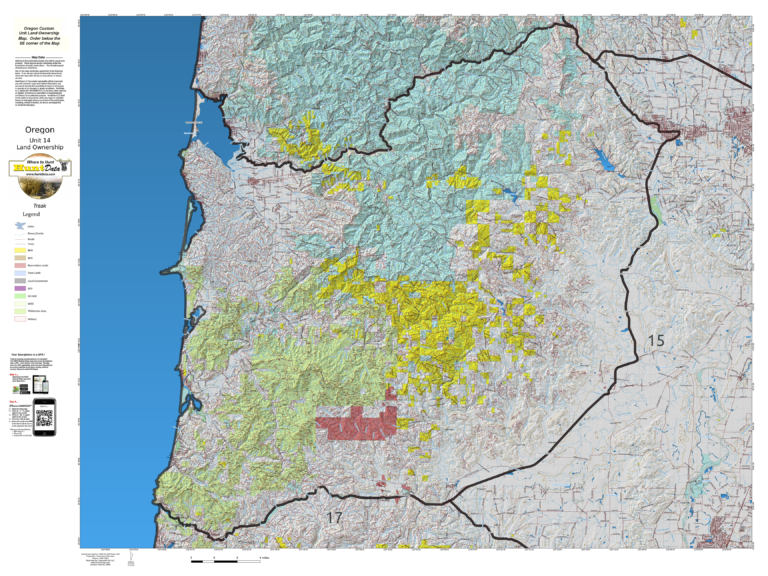

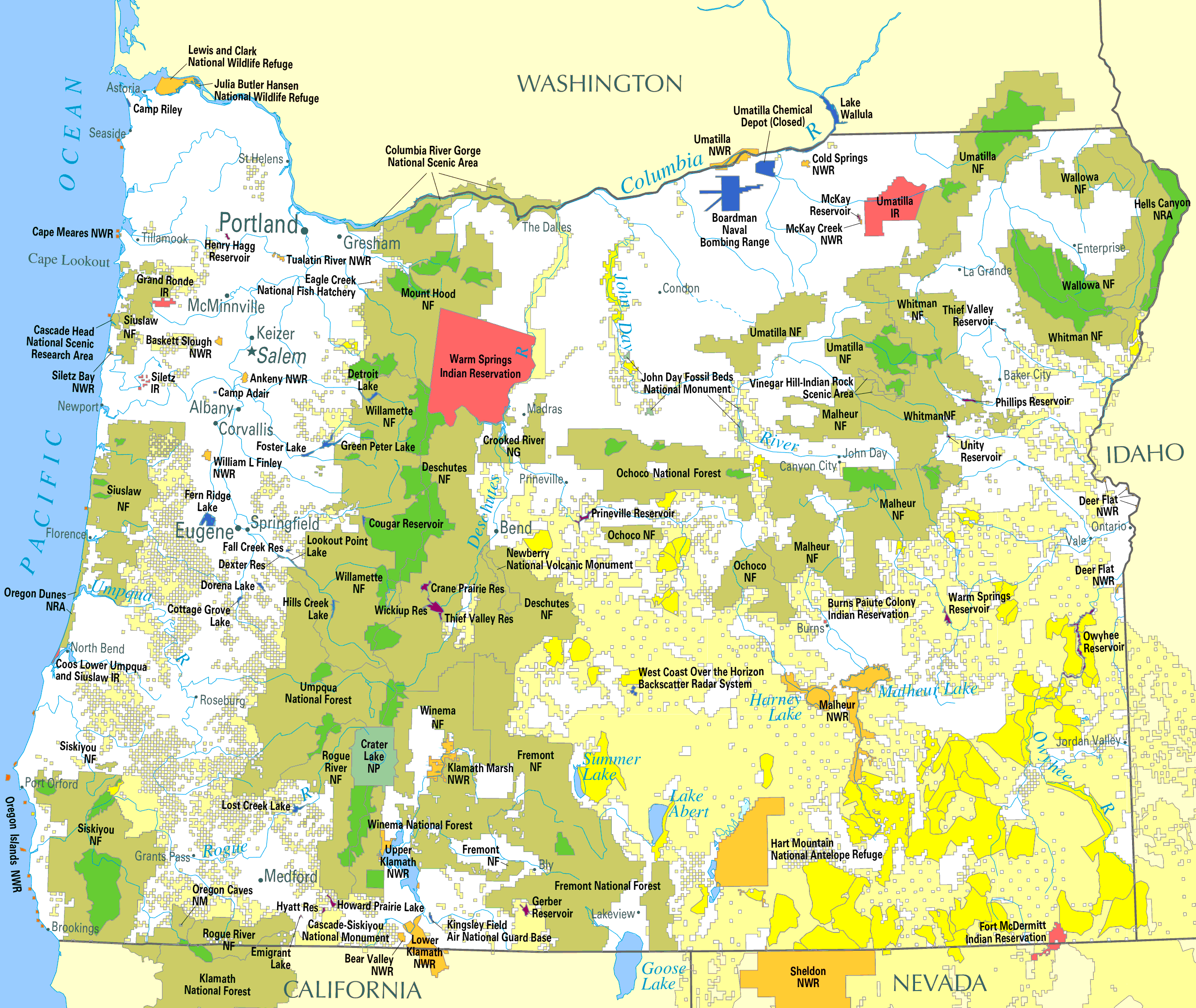

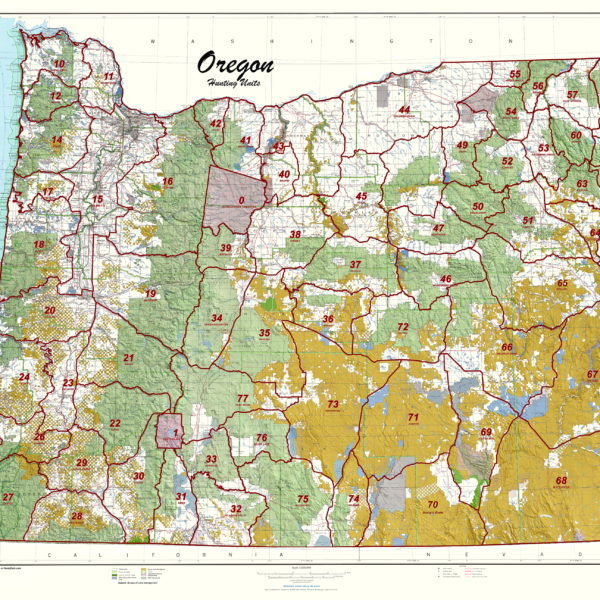

Oregon Tax Maps, a vital resource for understanding land ownership and property information, provide a comprehensive and accessible platform for navigating the complexities of real estate in the state. These maps, maintained by the Oregon Department of Revenue (DOR), serve as a foundational tool for a wide range of stakeholders, from individual property owners to government agencies and real estate professionals.

Understanding the Structure of Oregon Tax Maps

Oregon Tax Maps are organized by county and further divided into townships, ranges, and sections. Each section, encompassing one square mile, is then subdivided into smaller parcels, each assigned a unique identification number. This meticulous system ensures precise location and identification of every property within the state.

Accessing Oregon Tax Maps: A User-Friendly Approach

The DOR provides convenient access to Oregon Tax Maps through its online portal. Users can search by property address, owner name, or parcel number, allowing for targeted information retrieval. The platform offers interactive maps, downloadable PDF files, and detailed property information, including:

- Legal Description: Precise legal description of the property boundaries.

- Ownership Information: Names and addresses of current property owners.

- Tax Assessment Data: Current property value and tax obligations.

- Zoning Information: Land use designations and restrictions.

- Property Features: Information about buildings, structures, and other features.

Benefits of Utilizing Oregon Tax Maps

Oregon Tax Maps serve as a critical resource for various purposes:

- Property Owners: Understanding property boundaries, assessing property value, and managing tax obligations.

- Real Estate Professionals: Identifying potential properties, conducting due diligence, and facilitating transactions.

- Government Agencies: Planning and development, property tax assessment, and land management.

- Public Access: Providing transparent and accessible information regarding land ownership and property details.

Beyond the Basics: Delving Deeper into Oregon Tax Maps

Oregon Tax Maps offer a wealth of information beyond basic property details. Advanced features include:

- Historical Data: Accessing past ownership records and tax assessments, providing valuable insights into property history.

- GIS Integration: Utilizing geographic information system (GIS) technology to visualize and analyze spatial data related to land ownership and property characteristics.

- Property Value Trends: Identifying patterns in property value fluctuations over time, offering valuable insights for investment decisions.

FAQs Regarding Oregon Tax Maps

Q: How do I find a specific property on Oregon Tax Maps?

A: You can search by property address, owner name, or parcel number through the DOR’s online portal.

Q: What information is included on a property record?

A: Property records contain legal description, ownership information, tax assessment data, zoning information, and property features.

Q: Are Oregon Tax Maps accurate and up-to-date?

A: The DOR strives to maintain accurate and up-to-date information, but it is essential to verify details with local authorities.

Q: How often are Oregon Tax Maps updated?

A: Updates occur regularly based on changes in ownership, property features, and tax assessments.

Q: Are there any fees associated with accessing Oregon Tax Maps?

A: Accessing Oregon Tax Maps through the DOR’s online portal is generally free of charge.

Tips for Effective Use of Oregon Tax Maps

- Start with a clear purpose: Define your objective for accessing the maps, whether property research, investment analysis, or land management.

- Utilize the search functionality: Take advantage of the advanced search features to quickly locate specific properties.

- Verify information: Always cross-reference information obtained from the maps with other sources, such as local government records.

- Stay informed about updates: Regularly check for updates to ensure you are working with the most current data.

- Seek professional assistance: For complex inquiries or legal matters, consult with a qualified professional such as a real estate attorney or surveyor.

Conclusion: The Power of Transparency and Accessibility

Oregon Tax Maps, with their comprehensive information and user-friendly access, empower individuals, businesses, and government agencies with valuable insights into land ownership and property details. This transparency fosters informed decision-making, promoting fair property valuation, efficient land management, and responsible real estate development. As a vital resource for understanding the landscape of Oregon, Oregon Tax Maps play a crucial role in shaping the future of the state’s land and property market.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Land: A Comprehensive Guide to Oregon Tax Maps. We thank you for taking the time to read this article. See you in our next article!