Navigating the Landscape of Car Insurance Prices in Oregon: A Comprehensive Guide

Related Articles: Navigating the Landscape of Car Insurance Prices in Oregon: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape of Car Insurance Prices in Oregon: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Car Insurance Prices in Oregon: A Comprehensive Guide

Oregon, with its diverse landscapes and bustling cities, presents a unique environment for car insurance pricing. Understanding the factors that influence these prices is crucial for drivers seeking the most competitive rates. This article delves into the intricate world of Oregon car insurance, exploring the key variables that shape its cost and providing insights into navigating this complex landscape.

Understanding the Core Factors Influencing Car Insurance Prices in Oregon

Several factors contribute to the wide range of car insurance prices observed across Oregon. These factors are interconnected and interact in complex ways, making it essential to consider them holistically when analyzing insurance costs.

1. Demographics and Risk Assessment

- Age and Driving Experience: Younger drivers, particularly those with limited driving experience, are statistically more likely to be involved in accidents. This elevated risk translates into higher insurance premiums. Conversely, mature drivers with extensive driving records often enjoy lower rates due to their lower accident probability.

- Driving History: A clean driving record is a significant factor in determining insurance premiums. Drivers with past accidents, traffic violations, or DUI convictions face higher premiums as they are perceived as higher risks.

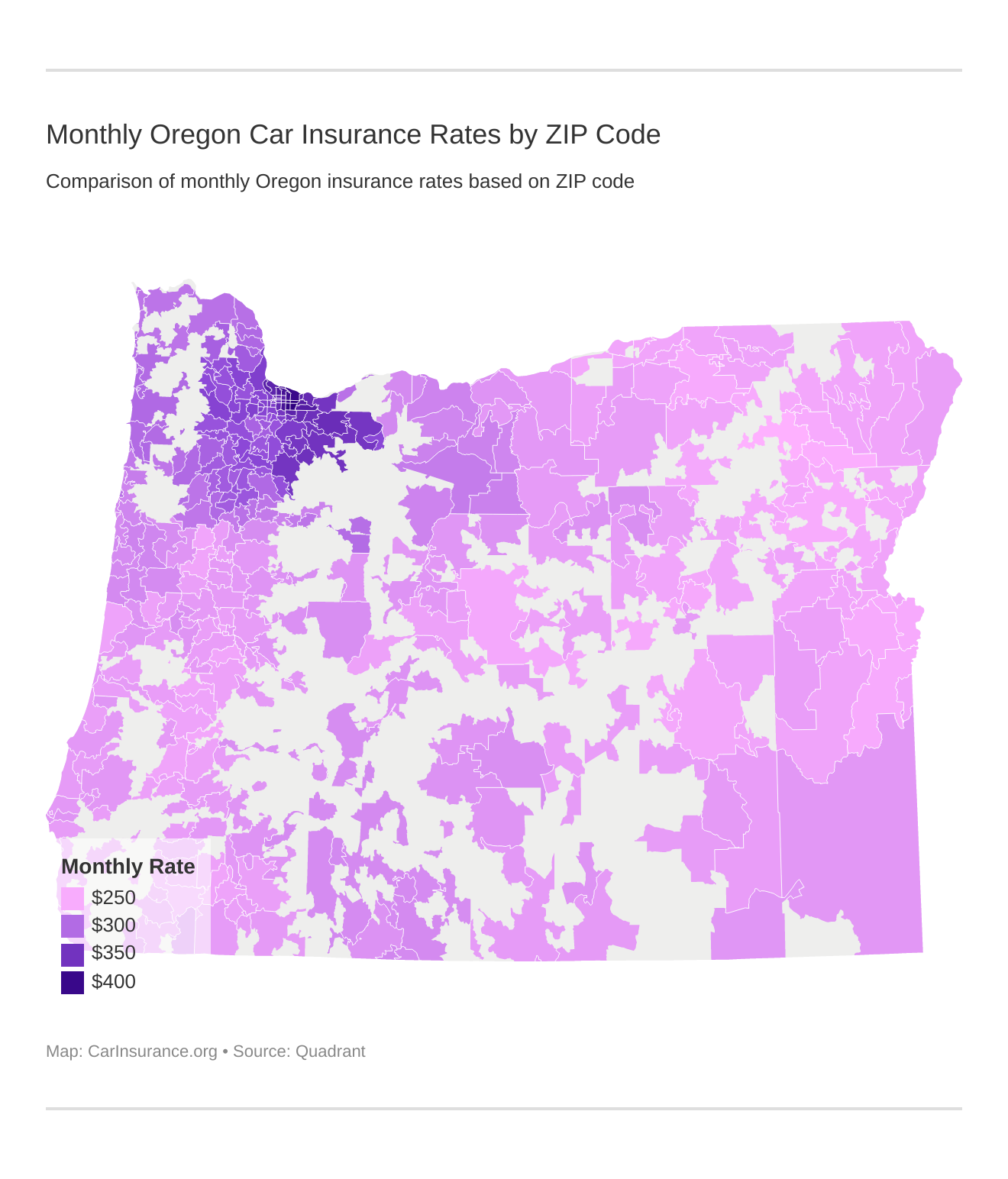

- Location: Geographic location plays a crucial role in insurance pricing. Areas with high traffic density, crime rates, or severe weather conditions generally have higher insurance costs. In Oregon, urban areas like Portland and Eugene tend to have higher insurance rates compared to more rural areas.

- Vehicle Type and Value: The make, model, and year of a vehicle, along with its safety features and estimated repair costs, influence insurance premiums. Higher-value vehicles, luxury cars, and those with advanced safety technologies often attract higher insurance rates due to their potential for greater repair expenses.

2. Coverage and Policy Options

- Liability Coverage: This essential coverage protects drivers financially in case of an accident where they are deemed at fault. Higher liability limits, which provide greater financial protection, result in higher premiums.

- Collision and Comprehensive Coverage: These coverages protect against damage to the insured vehicle from accidents and other perils, such as theft or vandalism. Higher coverage limits and deductibles (the amount the insured pays before the insurer covers the remaining costs) influence premiums.

- Uninsured/Underinsured Motorist Coverage: This coverage protects drivers in accidents involving uninsured or underinsured motorists. Higher coverage limits often lead to higher premiums.

- Additional Coverage Options: Various additional coverage options, such as roadside assistance, rental car reimbursement, and personal injury protection, can impact premiums.

3. Competitive Landscape and Market Forces

- Insurance Company Practices: Each insurance company employs its own risk assessment models and pricing strategies. These factors can significantly influence the premiums offered.

- Market Competition: The level of competition among insurance companies in a specific area can impact pricing. Regions with a high concentration of insurance providers may experience more competitive rates.

Visualizing Car Insurance Prices in Oregon: The Power of Maps

Visualizing car insurance prices across Oregon using maps provides a valuable tool for understanding regional pricing variations. These maps can reveal trends and patterns that might not be apparent from numerical data alone.

Benefits of Utilizing Car Insurance Price Maps:

- Identifying Regional Differences: Maps highlight the disparities in insurance costs across different areas of Oregon, allowing drivers to compare prices in their local region.

- Understanding Pricing Trends: Maps can reveal patterns in insurance pricing, such as higher rates in urban areas or along specific highways.

- Making Informed Decisions: By visualizing pricing trends, drivers can make more informed decisions when choosing an insurance company and coverage options.

Limitations of Car Insurance Price Maps:

- Average Prices: Maps often display average prices, which may not reflect individual circumstances or specific vehicle types.

- Limited Data: Maps may not include all insurance companies or coverage options, potentially leading to incomplete information.

Navigating the Car Insurance Landscape: Tips for Finding Competitive Rates

- Compare Quotes from Multiple Insurers: Obtaining quotes from several insurance companies allows drivers to compare prices and coverage options.

- Consider Bundling Policies: Combining multiple insurance policies, such as car and homeowners insurance, with the same company can often lead to discounts.

- Explore Discounts: Many insurance companies offer discounts for good driving records, safety features, and other factors.

- Review Coverage Needs Regularly: As life circumstances change, it’s crucial to review insurance coverage needs and adjust policies accordingly.

- Shop Around Periodically: Regularly comparing rates from different insurers can help ensure that drivers are getting the best possible price.

FAQs Regarding Car Insurance Prices in Oregon

1. What are the average car insurance prices in Oregon?

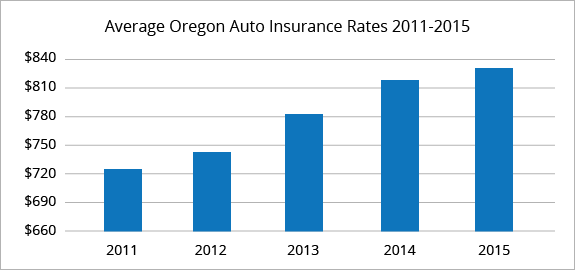

Average car insurance prices in Oregon can vary widely depending on the factors discussed above. However, according to recent data, the average annual premium for full coverage car insurance in Oregon is around $1,500.

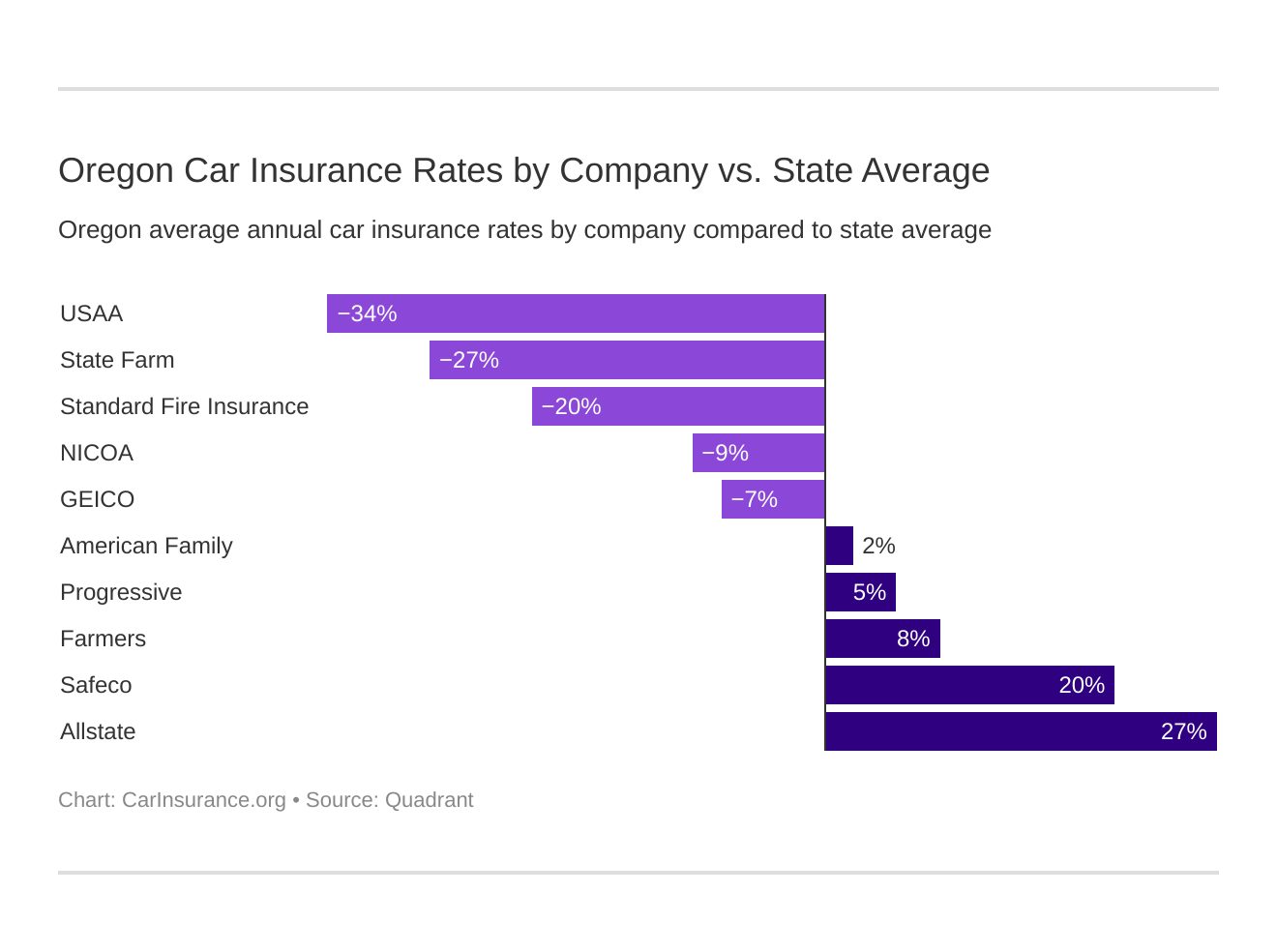

2. What are the cheapest car insurance companies in Oregon?

The cheapest car insurance companies in Oregon can vary depending on individual circumstances. However, some companies consistently offer competitive rates, including Geico, USAA, and State Farm.

3. How can I reduce my car insurance premiums in Oregon?

Drivers can reduce their premiums by maintaining a clean driving record, taking defensive driving courses, installing safety features, and bundling policies.

4. What are the mandatory car insurance coverages in Oregon?

Oregon requires drivers to carry liability insurance, covering bodily injury and property damage to others in an accident.

5. What happens if I drive without car insurance in Oregon?

Driving without car insurance in Oregon is illegal and can result in fines, license suspension, and potential jail time.

Conclusion

Car insurance prices in Oregon are influenced by a complex interplay of factors, including demographics, vehicle characteristics, coverage options, and market forces. Understanding these factors is crucial for drivers seeking the most competitive rates. By utilizing online tools, comparing quotes, and exploring discounts, drivers can navigate the insurance landscape effectively and secure the best possible coverage for their needs. Remember, staying informed and proactive is key to securing affordable and reliable car insurance in Oregon.

![Oregon Auto Insurance [Quotes + Definitive Coverage Guide] AutoInsurance.org](https://www.autoinsurance.org/wp-content/uploads/dw/oregon-auto-insurers-by-market-share--MORJe.png)

![Oregon Car Insurance Cost for 2024 - [Cheapest Rates + Rankings]](https://insuraviz.com/wp-content/uploads/oregon-car-insurance-feature.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Car Insurance Prices in Oregon: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!