A Comprehensive Look at Oregon’s Housing Price Map: Trends, Insights, and Implications

Related Articles: A Comprehensive Look at Oregon’s Housing Price Map: Trends, Insights, and Implications

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to A Comprehensive Look at Oregon’s Housing Price Map: Trends, Insights, and Implications. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

A Comprehensive Look at Oregon’s Housing Price Map: Trends, Insights, and Implications

Oregon’s housing market, like many others across the United States, has experienced significant shifts in recent years. Understanding these shifts requires more than just a snapshot of current prices; it necessitates a nuanced analysis of historical trends, geographic variations, and underlying economic factors. This article delves into the intricacies of Oregon’s housing price map, providing a comprehensive overview of its key features, insights, and implications for both residents and policymakers.

Mapping the Landscape: A Geographic Overview

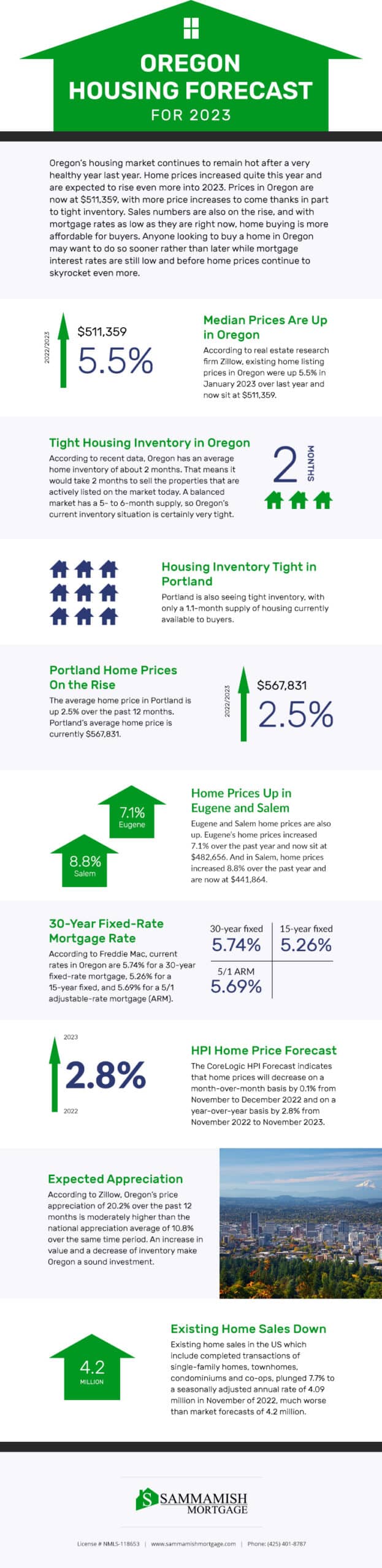

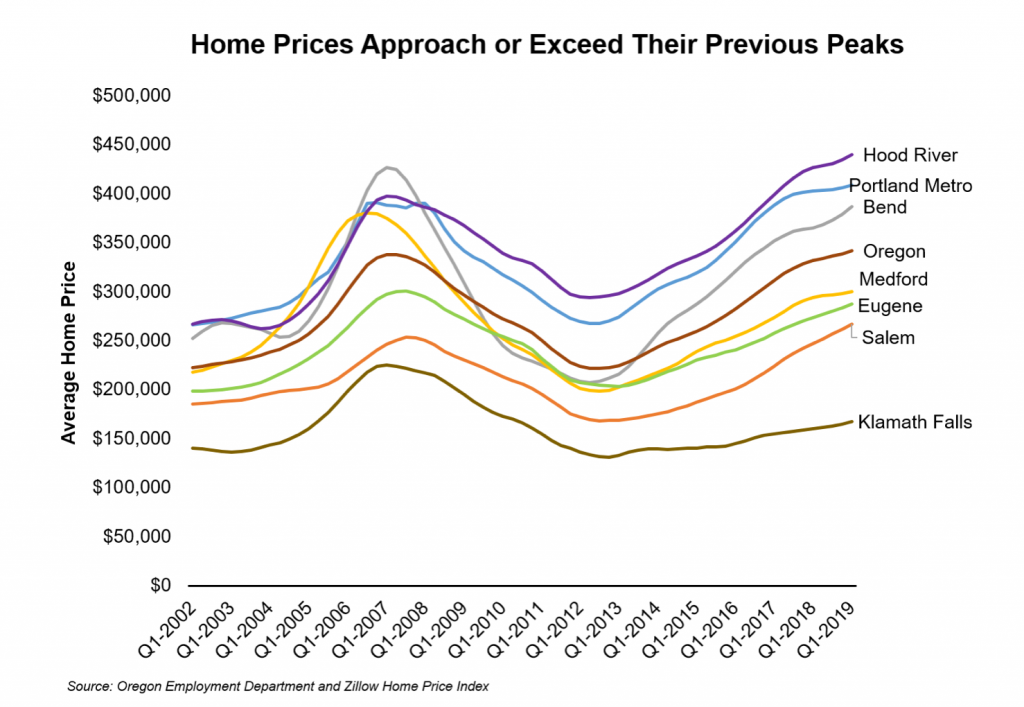

Oregon’s housing market exhibits a distinct geographic pattern, with prices varying significantly across different regions. The Portland metropolitan area, including its surrounding suburbs, consistently commands the highest prices. This is driven by a combination of factors, including a strong job market, a desirable lifestyle, and limited housing supply.

Urban Centers and Suburban Sprawl:

- Portland Metro Area: The city of Portland itself, along with its surrounding suburbs like Beaverton, Hillsboro, and Tigard, experiences the highest housing prices. This area boasts a vibrant economy, diverse cultural offerings, and excellent infrastructure, making it a highly sought-after location for both residents and businesses.

- Salem and Eugene: These smaller metropolitan areas also witness considerable demand, though prices generally remain lower than those in the Portland metro. Both cities serve as regional economic hubs, attracting residents seeking a more affordable alternative to the larger metropolitan area.

- Coastal Communities: The Oregon Coast offers breathtaking scenery and a relaxed lifestyle, attracting retirees and those seeking a slower pace of life. This demand, coupled with limited housing supply, often pushes prices higher in coastal communities like Cannon Beach, Newport, and Astoria.

- Rural Areas: In contrast to urban centers and coastal towns, rural areas of Oregon generally experience lower housing prices. This is often attributed to a slower pace of life, fewer job opportunities, and a more limited infrastructure.

Historical Trends and Market Fluctuations

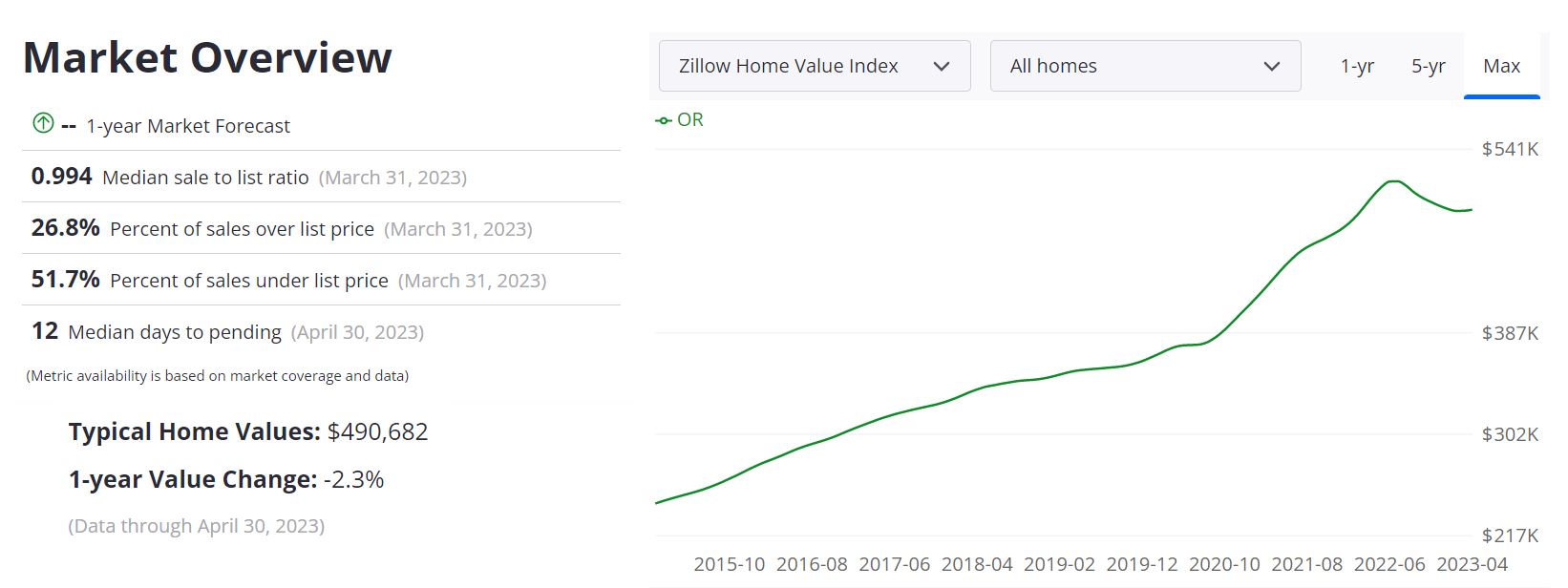

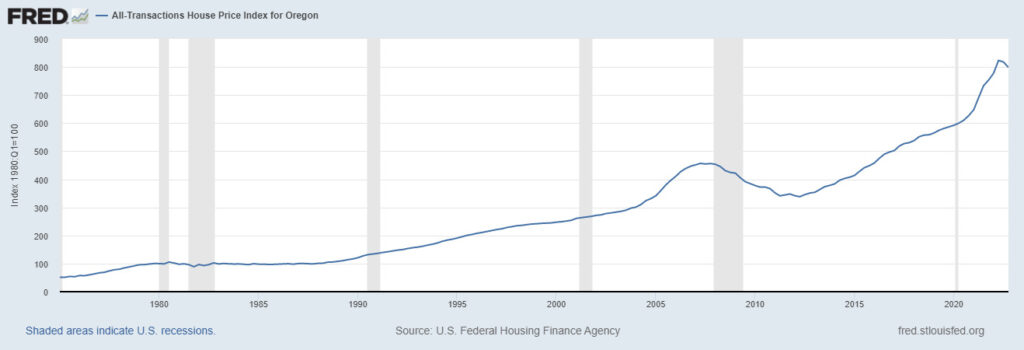

Oregon’s housing market has experienced significant fluctuations over the past few decades. Understanding these trends is crucial for grasping the current market dynamics and anticipating future shifts.

The Boom Years (2000-2007): This period saw a rapid rise in housing prices across Oregon, fueled by low interest rates, a robust economy, and a surge in demand. The growth was particularly pronounced in the Portland metro area, with prices exceeding national averages.

The Bust (2008-2012): The global financial crisis of 2008 had a significant impact on Oregon’s housing market, leading to a sharp decline in prices. This downturn was driven by a combination of factors, including the bursting of the housing bubble, tighter lending standards, and a weakened economy.

The Recovery (2013-Present): Following the recession, Oregon’s housing market began a gradual recovery, with prices steadily increasing. This rebound was fueled by a combination of factors, including a strengthening economy, low interest rates, and a growing population.

Understanding the Drivers of Price Changes

Several key factors influence housing prices in Oregon, shaping the market dynamics and determining the affordability landscape.

Economic Growth and Job Market: A strong economy and a robust job market are key drivers of housing demand. As businesses thrive and employment opportunities increase, more people are drawn to an area, leading to increased competition for housing and higher prices.

Interest Rates: Interest rates play a significant role in housing affordability. Lower interest rates make mortgages more affordable, stimulating demand and pushing prices higher. Conversely, higher interest rates can cool the market, making it more difficult for buyers to qualify for loans and leading to price stagnation or even declines.

Population Growth and Demographics: Oregon’s population has been steadily growing in recent years, fueled by both domestic migration and international immigration. This influx of new residents creates increased demand for housing, pushing prices upward. The demographic composition of the population, including the age distribution and household size, also influences housing preferences and demand.

Housing Supply: The availability of housing units plays a crucial role in determining affordability. A limited supply of homes, especially in desirable areas, can lead to higher prices as demand outpaces supply. Conversely, a surplus of housing units can put downward pressure on prices.

Government Policies and Regulations: Government policies and regulations, including zoning laws, building codes, and tax incentives, can significantly influence housing affordability. For example, restrictive zoning laws that limit development can contribute to limited housing supply and higher prices.

The Importance of Understanding Oregon’s Housing Price Map

Understanding the nuances of Oregon’s housing price map is crucial for a variety of stakeholders, including:

- Homebuyers: A comprehensive understanding of the market allows homebuyers to make informed decisions about where to purchase, what price range to target, and how to navigate the competitive landscape.

- Sellers: Sellers can leverage their understanding of the market to price their homes competitively, attract potential buyers, and achieve a successful sale.

- Real Estate Professionals: Real estate agents and brokers rely on a deep understanding of the market to provide their clients with accurate information, effective strategies, and informed advice.

- Policymakers: Government officials and policymakers use market data to inform housing policy decisions, address affordability concerns, and promote sustainable growth.

FAQs about Oregon’s Housing Price Map

1. What are the factors driving the high housing prices in the Portland metro area?

The high prices in the Portland metro area are driven by a combination of factors, including a strong job market, a desirable lifestyle, and limited housing supply. The area attracts a large influx of residents seeking employment opportunities, cultural amenities, and outdoor recreation, leading to increased demand for housing. Additionally, restrictive zoning laws and limited land availability contribute to a shortage of housing units, further pushing prices upward.

2. Is Oregon’s housing market currently experiencing a boom or a bust?

Oregon’s housing market is currently experiencing a period of growth, with prices continuing to rise. However, the pace of growth has slowed compared to the boom years prior to the 2008 financial crisis. The market is characterized by a combination of factors, including a strong economy, low interest rates, and a growing population, which are supporting demand. However, concerns about affordability and potential market correction are emerging, particularly in the Portland metro area.

3. What are the implications of rising housing prices for renters in Oregon?

Rising housing prices often translate into higher rental costs. As homeownership becomes less affordable, more people are forced to rent, driving up demand for rental properties and pushing rents higher. This can create affordability challenges for renters, particularly those with lower incomes.

4. What steps can policymakers take to address the affordability challenges in Oregon’s housing market?

Policymakers can implement a range of measures to address housing affordability, including:

- Increasing Housing Supply: Encouraging development by relaxing zoning regulations, streamlining permitting processes, and providing incentives for affordable housing construction.

- Supporting Affordable Housing: Investing in affordable housing programs, providing subsidies for low-income renters, and promoting mixed-income developments.

- Addressing Land Use Policies: Examining zoning laws and land use regulations to ensure they are not creating artificial barriers to housing development.

- Improving Transportation Infrastructure: Investing in public transportation and alternative modes of transportation to reduce reliance on cars and make housing options in less central areas more accessible.

Tips for Navigating Oregon’s Housing Market

- Conduct Thorough Research: Before making any decisions, thoroughly research the specific areas you are considering, including housing prices, market trends, and community amenities.

- Work with a Reputable Real Estate Professional: Seek the guidance of a knowledgeable and experienced real estate agent who can provide insights into the market, negotiate on your behalf, and help you navigate the complex process of buying or selling a home.

- Secure Pre-Approval for a Mortgage: Obtain pre-approval for a mortgage before starting your home search, as this demonstrates your financial readiness to buyers and gives you a clear understanding of your budget.

- Be Patient and Persistent: The housing market can be competitive, so be prepared to be patient and persistent in your search. Don’t be discouraged by setbacks and keep working with your real estate agent to find the right property for your needs.

- Stay Informed about Market Trends: Monitor market trends, interest rate fluctuations, and economic indicators to make informed decisions about buying or selling a home.

Conclusion

Oregon’s housing price map is a dynamic and complex landscape, reflecting the interplay of economic forces, demographic shifts, and government policies. Understanding the nuances of this map is crucial for individuals, businesses, and policymakers alike. By analyzing historical trends, identifying key drivers of price changes, and implementing effective policies, Oregon can work towards creating a more equitable and affordable housing market for all its residents.

Closure

Thus, we hope this article has provided valuable insights into A Comprehensive Look at Oregon’s Housing Price Map: Trends, Insights, and Implications. We appreciate your attention to our article. See you in our next article!